SIX Network and FANDOM STUDIO Announce Partnership Collaboration to Advance Entertainment Industry

SIX Network is excited to announce our partnership with FANDOM STUDIO for the Fan-Fi project, making it easier for fans

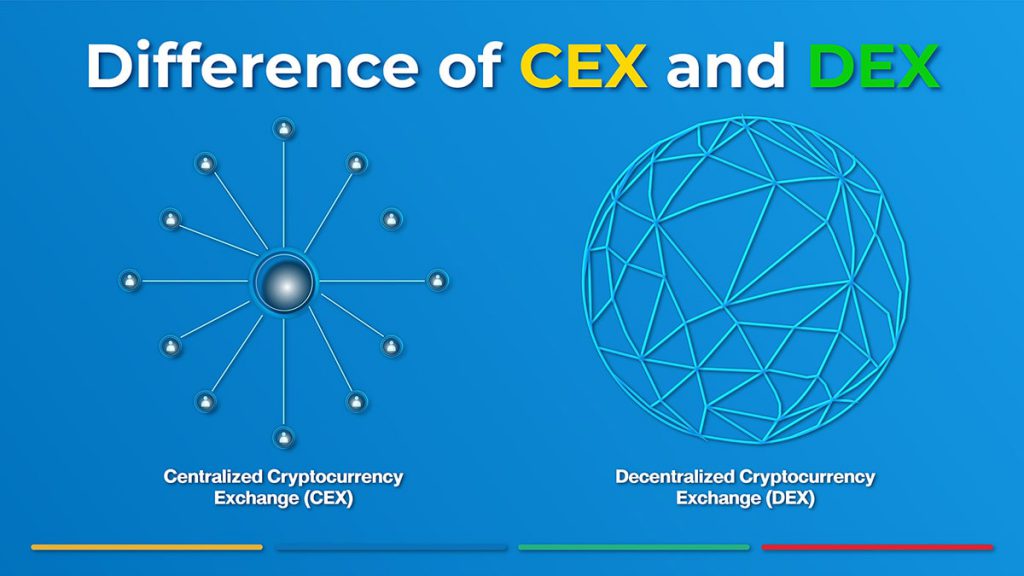

The rise of blockchain technology has divided the exchanges into two types. And these exchanges have their own pros and cons in the financial economy. In order to understand the difference between a centralized and decentralized exchange hereby is the brief scope of what they really mean.

DeFi essentially represents a broad category of financial platforms built on public blockchains. It refines and reverses the traditional financial system completely.

Combines protocols, tokens, and smart contracts to provide financial accessibility to individuals, (mostly) without the need for traditional banking channels. Some of the services currently offered in the DeFi space include exchange, payment processing, funds, and lending/borrowing.

Centralized exchanges (CEXs) are a type of cryptocurrency exchange that is operated by a company that owns it in a centralized manner. On the other hand, decentralized exchanges (DEXs) are executed on the blockchain (distributed ledger) technology.

In this way, DEX does not hold customers’ funds, positions, or information and only routes the orders of trading to a matching layer.

What exactly is the part of CEX causing the dissatisfaction that led to the development of DEX? From the forum Centralized Exchange (CEX) – Old-Fashioned But Still Strong has its own contradiction in its narration.

The centralized exchange also forces traders to deposit funds in the exchange. This makes it easier for exchanges to manage funds in bulk, but the customer has no control over their funds. The customers may not be able to withdraw when they want to, or may not even receive their assets when the exchange is hacked.

They further say that transactions on DEXs are slower, but it comes with blockchain on the backend with a stronger security system, granting authoritativeness to the owners, and it is a peer-to-peer operation.

Centralized Exchange

– Depositing fiat money (debit/credit) or cryptocurrencies.

– Giving up control over that amount of currency.

– Do not own the private key to the money.

– Work on an order book and the transactions are done using the exchange’s own database.

– Faster and no delays.

– Comes at the price of independence: you have to trust the exchange with your money.

Decentralized Exchange

– Invest in cryptocurrencies.

– Owns the private key to the cryptocurrencies.

– Full control of your money.

– Executes on the blockchain with smart contracts.

– Manageable on every transaction and depositing amount.

– Comes at the price of dependence: non-custodian, flexibility, and traceability.

Let’s talk about in real life situation when you needed to borrow some money from someone you know, first you have to know if he or she has the amount or the currency that you want with them or not.

If the lender does not have that amount of money or specific currency you need this situation equals to the lacking of liquidity.

In fact it is similar to the decentralized exchange where, this exchange is well known in the title “swap” hence the swap protocol on many DeFi platforms for example Uniswap, PancakeSwap, SushiSwap, etc.

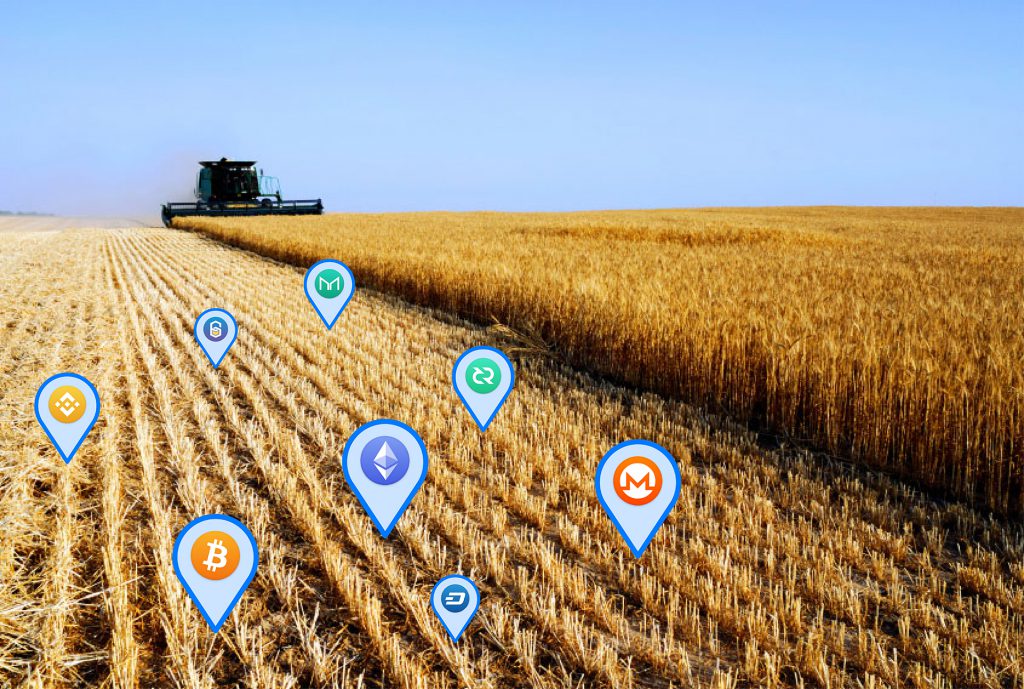

The sub-section of DEX is swapping which originally occurred on the Ethereum chain. It allows users to seamlessly exchange or swap tokens in hosted pools and offers yield farming incentives to liquidity providers.

This is the advantage of practicing decentralized exchange in cryptocurrency where users do not have to worry about the liquidity of the currency in which they need for an exchange. The currencies are stored on the respective pool and blockchain of each platform ready to be used in the exchange activities.

Usually, users are attracted to be the liquidity provider with beneficial returns. By providing the cryptocurrencies to the pool users “sell” the currency they own and receive yield as a return.

In the exchange under a decentralized network, users are able to swap the pairs of tokens supported in the specific chain (e.i. ERC-20: DAI for ETH). The key benefit of swapping in DeFi is that it is noncustodial.

The assets can be customized in a smart contract with the rights of asset owners that can be exercised at any time and is only complete when the exchange conditions are agreed to and met by all parties. If any condition is not met, the entire transaction is canceled.

Yield farmers are incentivized for provisioning liquidity or providing other value-added services to a decentralized application’s ecosystem. Yield farmers are paid with pro-rate in native governance token, granting the user a higher Annual Percentage Yield (APY) on their provisioned liquidity.

DEX and the liquidity pool share their relationship on the DeFi system and cannot stand alone. It probably is the new way to get involve in the decentralized finance investment to harvest income passively with an interesting return rate.

Lastly, SIX Network is about to launch the newest, biggest project ever on the DeFi space wherein this hour no one hasn’t heard off. SIX wanted to emphasize and encourage everyone to trade with the advancement of knowledge material and with confidence.

Our participation in recreating the DeFi platform for the decentralized exchange and investing fund is the mission to help investors whether beginning or expert level to trade on our platform without the hassles with the help of experts.

Passionate about financial world and is an inverstor too! Giving out news update and blog post every month.

Visit us at SIX Network for more.

SIX Network is excited to announce our partnership with FANDOM STUDIO for the Fan-Fi project, making it easier for fans

SIX Network มีความยินดีอย่างยิ่งที่จะประกาศร่วมเป็นพาร์ทเนอร์กับ FANDOM STUDIO เพื่อพัฒนาอุตสาหกรรมสื่อและวงการบันเทิงให้เติบโตยิ่งขึ้น ผ่านนวัตกรรมบล็อกเชนจาก SIX Ecosystem การร่วมมือกันครั้งนี้เป็นการส่งเสริมธุรกิจหรือวงการบันเทิง หรือ สร้างกิจกรรมที่ทำให้แฟนคลับกับผู้ใช้งานสามารถเข้าถึงศิลปิน, ไอดอล, ผลงานเพลง และสิทธิประโยชน์อื่น ๆ จาก Fan-Token NFT ซึ่งเป็นเหรียญประจำแพลตฟอร์มที่ใช้งานเพื่อรับสิทธิพิเศษต่าง

SIX Token จะถูกลิสต์บน Bitget แพลตฟอร์มแลกเปลี่ยนคริปโตชั้นนำ ในวันที่ 29 เมษายน 2567 SIX Network บริษัทผู้ให้บริการด้าน Blockchain Solutions ได้ประกาศการลิสต์ SIX token ($SIX) ใน

SIX Token is Listing on Bitget Best Copy Trading Platform on April 29, 2024 SIX Network, a prominent player

Let’s get to know Ethereum’s Next Big Thing “EigenLayer” Protocol Hottest Ecosystems. Currently! You can’t miss EigenLayer these days –

SIX Network made strategic advancements in the first quarter of 2024, announcing our Roadmap 2024. Key milestones were established, with

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |