Let’s get to know Ethereum’s Next Big Thing “EigenLayer”

Let’s get to know Ethereum’s Next Big Thing “EigenLayer” Protocol Hottest Ecosystems. Currently! You can’t miss EigenLayer these days –

A few days ago I came across a question from a friend asking,

“Do you have time to explain to me what a rebalancing strategy is and when should I do it?”

I simply answered, “It’s the act of realigning your portfolio back to its origin allocation of the assets.”

If you ever wonder what often is the cause which helps investors to tolerate the risk they’re probably going to face during the trading trivial, the answer is how they manage their risk.

Rebalancing Portfolio is a simple investment technique which is a construction of a portfolio that fits individual risk tolerance and investment goals and has been used in traditional investment for decades.

Advantages of Rebalancing Portfolio

“First you must find what type of rebalancing will suit you best.”

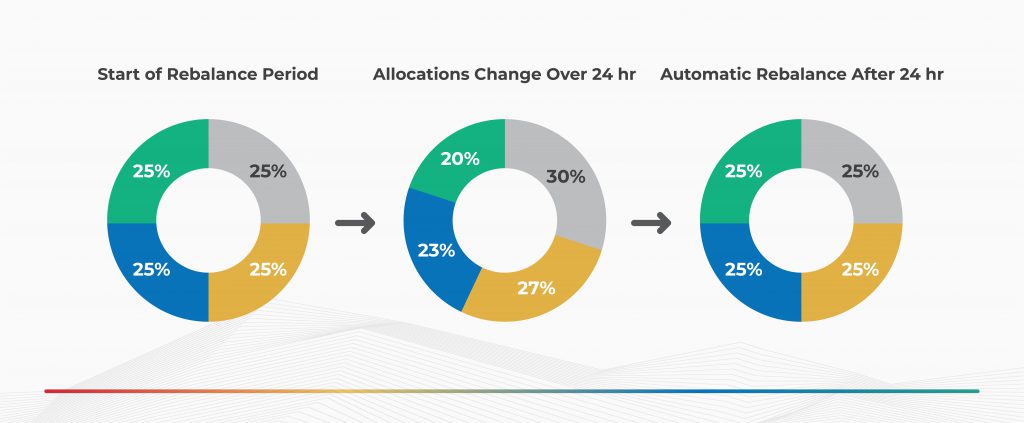

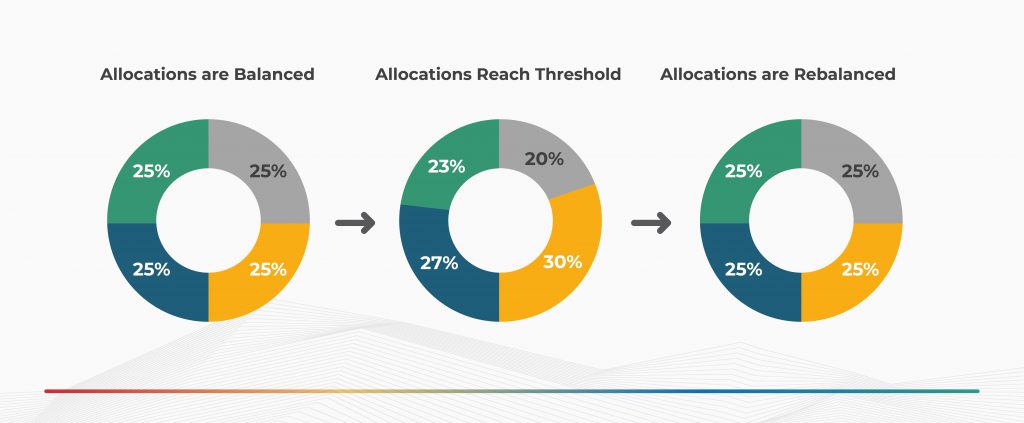

There are two types of rebalancing, the first one is periodic-based and the second is threshold. Rebalancing your portfolio involves selling some investments and buying others to restore an investment portfolio that matches your target asset allocation.

Factor 1: “Risk management - the purpose is not because of the best return rate, but because the risk of the portfolio is returned to the planned level.”

Lets see the following example here

Assuming the portfolio has 4 different assets and set the level of risk allocation to 25% for each asset, total up to 100% in the portfolio.

Let’s say in 24 hours asset A yields 30%, B 20%, C 23%, and D 27%. To rebalance this portfolio is to sell off excess yield then buy back another, the proportion will return to the same level of 25% per assets.

I continue, “This is what is known as periodic rebalancing, you rebalance once depending on the time you presumably take. Also there is another type known as threshold.” I started explaining again.

The demonstration of a threshold rebalance depends on the owner’s setting level of how much they want to reset the portfolio which will trigger them when to react. Example when the assets are -+5% on an asset with a 25% target allocation, the rebalance will occur once.

“A rebalance would happen as soon as one of those assets consumes less than 20% or more than 30% of the portfolio value, referring to the previous example.”

When creating an investment portfolio, you should be familiar with the concepts of asset allocation and diversification. When a portfolio consists of different asset classes like governance token, altcoin, stablecoin for instance it’s known as asset allocation.

When you distribute your investment funds across different assets or sectors is known as diversification such as consisting of SIX, BTC, DOGE, FINIX and more in the collection. Having a handful of different assets with different characteristics, you are making a reduction of risk for each allocation.

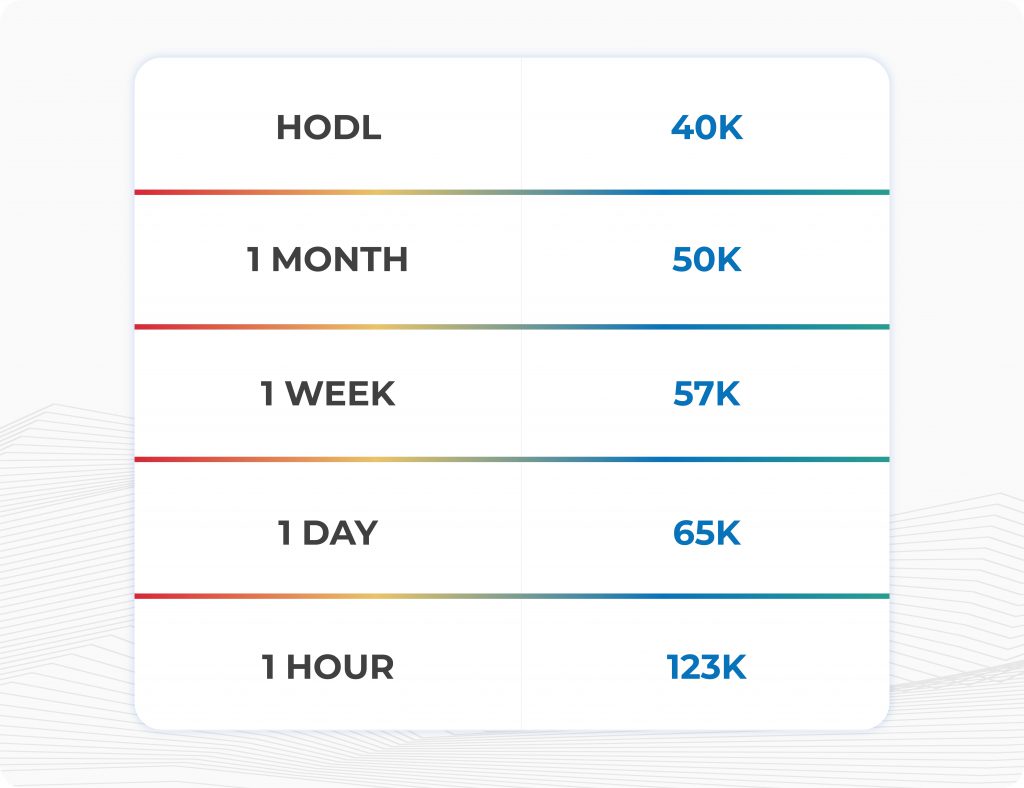

This figure is one of the examples of a rebalancing scenario conducted by Michael McCarty – Shrimpy Founder, showing a diversified portfolio.

Illustration of evenly distributed portfolios using rebalancing strategies varies from 1 hour, 1 Day, 1 Week, and 1 Month with a Holding portfolio. Returns results ranged from a $40K median with HODL to a $123K median through rebalancing every hour. (Investment of $5,000 value in 1 year.)

Common Rebalance Scenario

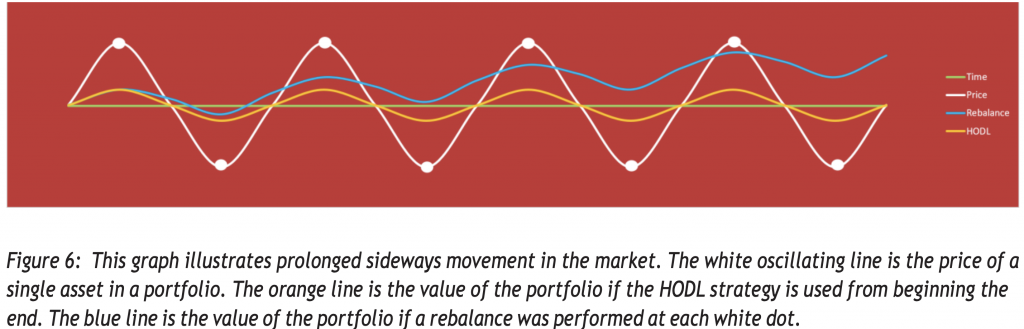

⦿ Sideways Movement – a simple sideways movement which takes place for a prolonged period. During this time, there are typically micro fluctuations, although the total value of the portfolio remains relatively flat.

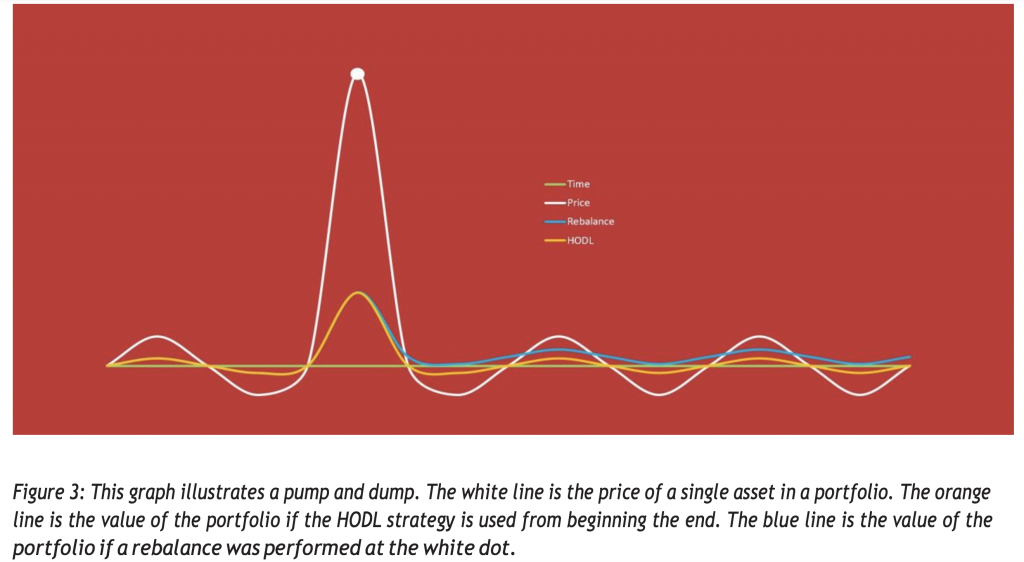

⦿ Pump and Dump – when a sharp increase in value is followed by a sharp decline in value for an asset. The result is a return to the original price.

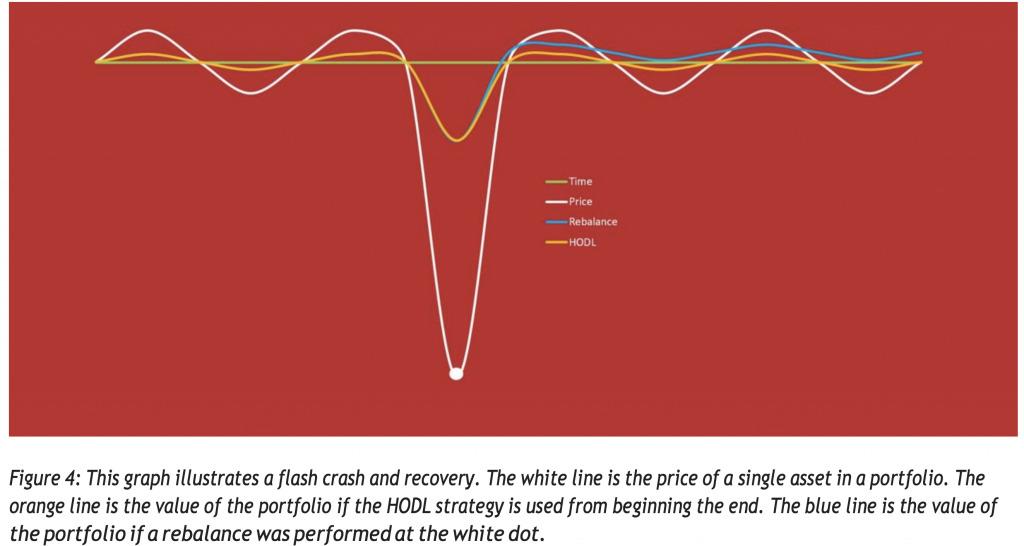

⦿ Flash Crash and Recover – Situation when a sharp value decline followed by a sharp value increase returning to the original price, ending and initial value stays the same.

Not all coins are expected to rise or drop in value during the same period. But what you can do best to save your revenue is by protecting the cause of loss and changes that for the opportunity you can take advantage of.

“Remember when the market didn’t go as planned and you haven’t gotten any ideas to stop your loss and profit?”, I asked my friend.

“Ha ha sure”, she replies.

Winning the market is when you can profit in trading of either crypto, forex, or stock in any occurrence of the market scenario. Surely enough it is a hard task to win without a winning strategy.

Factor 2: Therefore, a rebalanced portfolio is the opportunity cost to buy loss and sell profit of the diversified assets.

Most traders and investors are looking to beat the market with larger gains.

A highly diversified portfolio will lead to more average returns than a successful concentrated portfolio. Worse performing assets can balance out high earners.

Factor 3: Making suitable portfolio for each investment style and handling uncontrollable situation.

With that information, preparing yourself and using a bit of strategy will go a long way in creating a suitable portfolio for your risk tolerance. Worse case worse like in the situation where Bitcoin crash or wild swings of price within a day or a minute.

1. Risk Management

2. Opportunity to make profit in every interval

3. Handling uncontrollable situations

Are the main important factors you might want to consider when it comes to crypto trading.

Rebalancing your portfolio involves selling some investments and buying others to restore an investment portfolio that matches your target asset allocation. It is better off to have a well balanced portfolio than risking it all in a situation which is incredibly volatile.

Passionate about financial world and is an inverstor too! Giving out news update and blog post every month.

Visit us at SIX Network for more.

Let’s get to know Ethereum’s Next Big Thing “EigenLayer” Protocol Hottest Ecosystems. Currently! You can’t miss EigenLayer these days –

SIX Network made strategic advancements in the first quarter of 2024, announcing our Roadmap 2024. Key milestones were established, with

Get Ready for the Bitcoin Halving Day! Counting down just 2 days with SIX Network before we reach the historic

SIX Network, a leading blockchain for businesses, announced a strategic investment and partnership with ContributionDAO, an institutional graded blockchain infrastructure

2024 is an exciting year, with major events and trends set to occur. The approval of the Bitcoin ETF has

As we conclude 2023, this blog provides a concise yet thorough summary of our achievements and strategic efforts throughout the

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |